Australians are travelling more for business than ever before but travel insurance is often an after-thought. What does a broker need to know to convince a client to take the brokered route?

by Chris Sheedy

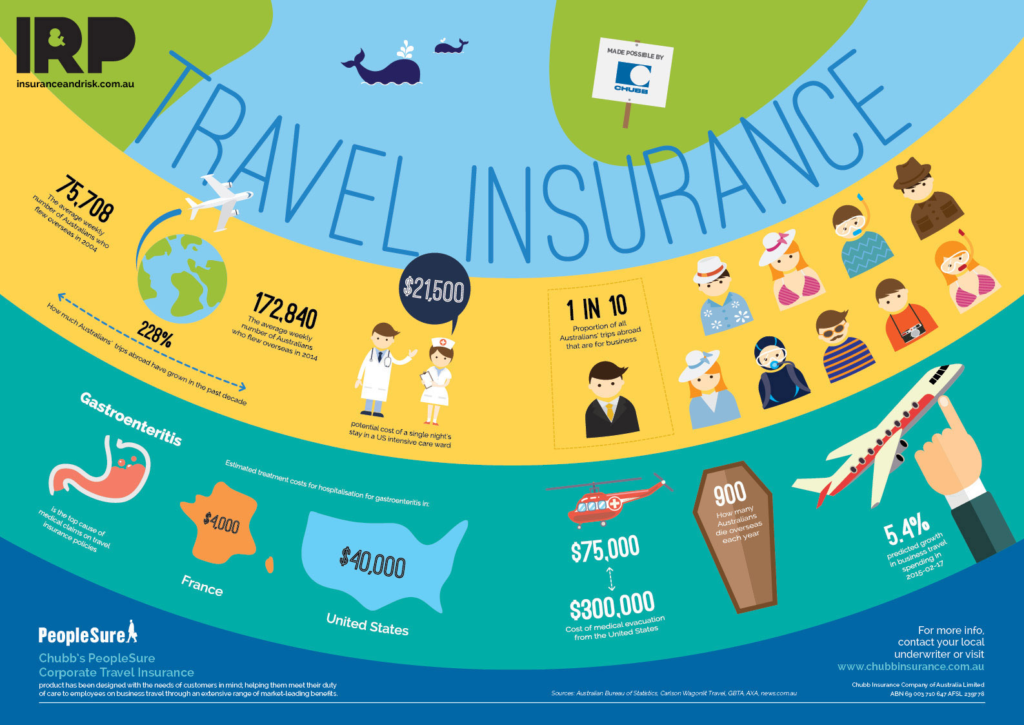

In the past decade, trips across Australia’s border have soared by almost three-quarters, from less than 19 million to more than 32 million. Of these international trips, one in 10 is for business.

That’s a healthy and growing market for corporate travel insurance premiums, which experts estimate to currently be worth somewhere between $200 and $400 million in Australia. But as corporate travel cover is often an afterthought – for brokers as well as clients – and as it competes with cheap or free cover offered by credit card companies and web-based insurance businesses, it typically does not receive the attention it deserves.

“It is amazing what a good corporate travel policy covers,” says Angus MacDougal, Australian Underwriting Manager for Accident & Health International. “Plus it is cheap and often gives the higher-ranking people in the company benefits they would otherwise not have had, such as leisure travel cover for themselves and for any family travelling with them.”

If a medical evacuation or a natural disaster evacuation is required, is the infrastructure available to manage the evacuation of employees?

“But it is important to understand what you are selling and how to sell it. You have to be able to explain the differences between a corporate travel policy and a credit card policy. The way to think about travel insurance is that you get premium products and you get free products. So-called ‘free’ products, such as credit card policies, are paid for by the providers. Obviously they don’t want to pay more than they have to, and the only way to keep costs down is to limit cover.”

COVER FOR ALL

Such cover limitations, says Melanie Barrett, National Accident & Health Manager with DUAL Australia, include medical expenses, especially if they relate to pre-existing conditions.

“The big difference is travel policies purchased online or free through a credit card typically contain many more exclusions than a corporate travel policy,” Barrett says. “One of the main exclusions is cover for pre-existing medical conditions. Corporate policies mostly cover pre-existing conditions as long as you are fit to travel.”

CLICK TO ENLARGE

“Another major exclusion to be aware of is around the insolvency of entities, such as travel agents or airlines. But note there are not many corporate travel policies that will cover this. Also, in the leisure wording, events such as war and terrorism are often excluded. Corporate policies typically cover events arising from war and terrorism, with exceptions for specific locations.”

CASE STUDY

Escaping BangkokIn 2008, when civil unrest caused rioting and military action in Bangkok, many foreigners fled to the airport. But all flights were grounded and soon the fighting reached the airport, with reports of gunshots and grenade explosions outside the buildings.

“It really boils down to what is covered under the policy and how good the assistance networks are,” says Angus MacDougal, Australian Underwriting Manager for Accident & Health International. “In this case there were three differences between the insurers; the cover, the assistance capability and the approval process for action to be taken. The differences resulted in a very different experience for the end users.”

Exclusions within broker-provided policies include travel within specific war zones, such as Iraq, Afghanistan and Somalia. Age limits are often placed on corporate travel cover, but many insurers keep these limits up around 80 or 85, and some have lifted the age to 100, with free and web-based policies tending towards lower age limits.

Other exclusions can include suicide and self-harm, piloting an aircraft, sexually transmitted diseases, losses related to illegal activities, and illness related to nuclear weapons and radiation.

A major benefit of a corporate travel policy is the personal level of treatment, especially from assistance networks when an evacuation or rescue is required. When, on the same day in 2008, the Mumbai terrorist attack occurred in India and civil unrest caused shooting, rioting and grenade-throwing around Bangkok Airport in Thailand, Accident & Health International had their specialist assistance network move in and evacuate their insureds from both danger zones (see case study #1).

MAPPING IT OUT

Chubb Australia’s Accident and Health National Manager Daniel Kenny says the developing world still poses the greatest risks to business travellers.

CASE STUDY

Sticker shock to the systemThe US healthcare system is notorious for the potentially bankrupting costs it can impose on patients, even for afflictions that seem routine.

“We see a large number of engineering, construction and infrastructure style companies that are sending travellers to South America, Africa and China that are now taking pre-trip risk management more seriously than ever,” he says.

Tim Christian, Head of Accident and Health Australasia with AIG, says some industries and regions are more challenging than others, particularly the oil and gas industry and the mining industry. For instance, within these industries there are many junior exploration companies travelling to such territories as Nigeria, Congo and other African countries to set up exploration sites.

“Given that some of these countries are third-world countries you have some issues about the medical care,” he says. “If a medical evacuation or a natural disaster evacuation is required, is the infrastructure available to manage the evacuation of the employee?”

Finally, it is also important that the client business conducts a full risk assessment and develops its own evacuation plans in consultation with their insurer, rather than expecting the insurer to take care of everything.

The big difference is travel policies purchased online or free through a credit card typically contain many more exclusions than a corporate travel policy.

“If you are a prudent underwriter you will generally ask what countries the insured employees are likely to be travelling to,” Christian says. “Depending on the country and location you may need to ask further questions and establish if they have a risk management plan in place, in case a medical emergency, environmental disaster or political unrest causes the need for an evacuation.

“You need to make sure the client is aware they are going to an isolated area in the Congo. Is the insurer’s assistance provider in a position to evacuate a person from there due to civil unrest resulting in military action or simply because of the environment and a lack of first-world medical facilities. Do they know where the nearest medical facility is located and is it up to first-world standards? Where are the airstrips located? Can we actually get someone out? All of these things need to be considered.”