The NIBA Mentoring Program attracts people from an assortment of backgrounds to take part in the sharing of hard-earned advice.

by Cecilia Harris

Changing career paths can yield doubt, even for the most resilient professionals.

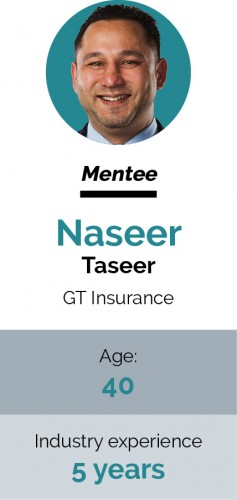

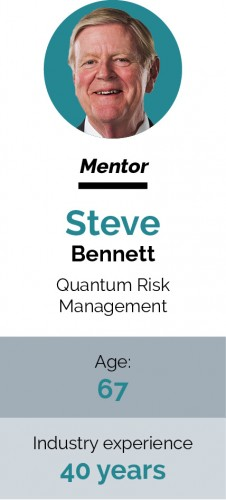

When Naseer Taseer entered the world of broking, he was determined to progress and learn quickly. NIBA’s mentoring program linked him up with Steve Bennett, who took pleasure in sharing his four-decade bank of knowledge with his younger counterpart.

Through the process, Naseer found new direction and transformed his career, while Steve was reminded that there’s nothing quite like an up-and-comer with enthusiasm and a good attitude.

“Prior to the mentoring program, I was a suburban broker dealing with policies in relation to transport businesses, comprehensive insurance products and compensation.

I have only recently converted, or changed careers, to insurance, which was about five years ago. I joined the mentoring program, which changed my career, to be honest. It gave me a better path.

When I started working within insurance I knew I wanted to be in this industry. I wanted to expand my horizons. I discovered the mentoring program through the NIBA website. I applied one year, and didn’t quite make the cut. The following year, I was accepted into the program and paired up with Steve Bennett.

We would meet up about once a week. We would catch up for a morning coffee, and we would just sit down and talk about work in general, about insurance and life. We would talk about where my career was heading and what I wanted to do. Steve was helpful in guiding me in the right direction. He never gave me the answers, but showed me where to look.

We talked about what I had done to date. I was very conscious of the fact that maybe I had left my career transition too late, and that maybe I was a little bit older than what I should have been at that stage.

Steve was very positive about what I brought to the table in terms of life experience, business experience and attitude. He did mention to me to work on my education and I haven’t stopped doing that since.

The program has absolutely changed my ongoing work practices. I’ve gone back to square one. One thing I have learnt is that insurance is a people business. You need to build relationships and you need to be patient.

I am a very impatient person by nature. I want things to happen instantaneously. I guess it’s a part of the generation that I grew up in. But things take time, relationships take time. And you just have to hang in there and build relationships and eventually, over time, you will succeed.

It’s been a case of going back and learning everything from the ground up, whether that’s policy wordings, claims processes, underwriting processes or just understanding the basics. I needed to know how to do all this in order to move onto more complex stuff.

I feel very fortunate to have met Steve and to still have access to his brain. He is legendary.

Apart from the fact that I still stay in touch with Steve and we catch up every now and then, I’ve met some really great people throughout the mentoring program. Not just the other mentors, but the other mentees too.

That has also built my relationships with people. I still catch up with them all every now and then and they are all still in the insurance industry. There are reunions that happen every now and again, it’s good to talk shop and it’s just been a very good relationship builder. I’ve made lifelong friends.

Meeting like-minded professionals was the standout benefit for me – building a network and learning from such an accomplished professional.

I still stay in touch with Steve, so I think the learning process is ongoing. I feel very fortunate to have met him and to still have access to his brain. He is legendary. Eventually, I’d like to get to a point where I can repay that and be a mentor too.”

“I’ve been involved in insurance for something like four decades, so I’m no spring chicken. It’s in the family and is very much a part of our lives. I guess it’s just a natural thing to want to continue to be a part of the development of the profession.

I put my hand up for the program and said, “if you’d like me to be involved then I’d be happy to be there.” I’ve been involved now for about five years.

What I try and do initially is get to know the mentee quite well. I explore all traits of their personality and how they go about enjoying their business.

I try and see what direction they are going in and then from there I set out how my experience can assist them. We discuss the way that they are working, and talk over their strengths and weaknesses.

Attitude is most important. I think for a person to be in the mentoring program in the first place, then they must be pretty reliable. If they want to be there, they must have some good qualities to start with.

They are halfway there with their attitude. I try to drill down on their strengths and flesh out options for discussion. Quite often a mentee will not have a fixed plan in place and the program assists in crystallising a direction.

It is quite a lengthy process and I find it rewarding to see their vision take shape.

The essential traits I discuss with mentees include a good attitude and reputation. These are the most important assets that anyone can have.

It takes years to earn a good reputation, and only a minute todestroy if attitude and principles are not adhered to as a way of life. The program offers a platform for people to look at themselves in regards to how they do business, how they relate to people and how they need to build up along-term reputation.

When I first met Nas, there was something about him. I was very impressed with his qualities as a person. Nas was an unusual mentee because he was a more mature candidate.

Having worked in the retail sector, he had some wonderful traits in relation to people-to-people skills. Nas showed an incredible desire to be involved in insurance, specifically broking.

We identified some things that he should consider in regards to career, like exams for further qualification, but Nas didn’t need too much tutoring in that regard because he was just so keen to become an insurance professional. His energy was there, drivern by a strong desire to succeed.

It is very rewarding to see him have come so far. Nas will be a man to watch, I think, in this industry.

Nas is a very enthusiastic guy and it was very easy for me to respond accordingly. That’s what makes it gratifying. If the mentee is enthusiastic and has the right attitude, it’s contagious and brings the best out in both of us.

People have great rapport with their workmates, but often they can’t discuss things with the same comfort level.

One of the most important things that everyone understands with the mentor program is that discussions are strictly confidential. Nothing is banned, but what is said stays there.

People enjoy having that confidentiality. And while you only meet once a week, the phone is always there, just for checking up on things or to have a chat.

Nas was in a job that I didn’t think was going to benefit his long-term aspirations, and we worked on that.

He made his own decision to make certain changes. He is doing very well. I find out about him from his workmates and his bosses, and it is very rewarding to see him have come so far. He will be a man to watch, I think, in this industry.

A lot of mentees are anxious to get going and want to soar at a high level, before they have learned to fly.

If you follow the right direction, are reliable and have a good attitude towards people, you will enhance your reputation, and then you mould yourself into a professional. I don’t consider it rocket science, but it is a life skill worth adopting. It’s how you deal withrelationships and doing the right thing.

It’s been a really satisfying to be able to pass on decades of experience. I believe you should pass the baton in the relay of life. If I can pass on experiences that assist a young and enthusiastic professional, and watch them take off in their own race, it is very rewarding.

Many of my friends are mature, experienced insurance people and when the opportunity arises I suggest they put their hand up for the program because it is so rewarding. To be able to give it back to the profession is really good.”