Event cancellation insurance can be a boon when the unexpected happens. So why is it still undersold?

by Elana Benjamin

In April 2015, violent rioting in Baltimore resulted in two baseball games being postponed; one just half an hour before play was due to start.

In 2011, the devastating Christchurch earthquake caused seven Rugby World Cup matches to be moved from Stadium Christchurch to other New Zealand venues.

And closer to home, the Rolling Stones had to cancel their November 2014 concert at Hanging Rock, near Melbourne, when Mick Jagger developed a throat infection.

BODY BLOW

Marsh broker Robert Low has observed that “most entertainers are quite committed to their events,” so they’re very reluctant to cancel their commitments. But as the Rolling Stones found in 2014, sometimes the unexpected does happen.

Riots, earthquake, illness – these are all unexpected occurrences. But for the organisers of the Baltimore baseball games, Christchurch rugby matches and Rolling Stones concert, such unforeseen occurrences would have had significant financial repercussions – unless they had event cancellation insurance cover.

Similarly, all event organisers, promoters and sponsors need to manage the risk of sudden, unpredictable occurrences that could disrupt their events. Given the heightened risk of terrorist activity worldwide, together with more extreme weather conditions caused by climate change, event cancellation insurance is more relevant than ever.

Despite this, many in the industry say event cancellation cover remains poorly understood in the Australian market.

THE BASICS

Also known as cancellation and abandonment insurance, event cancellation policies provide insurance in case an event is unavoidably cancelled, postponed, abandoned, interrupted, restricted or relocated. It’s a specialist product, tailored to each event.

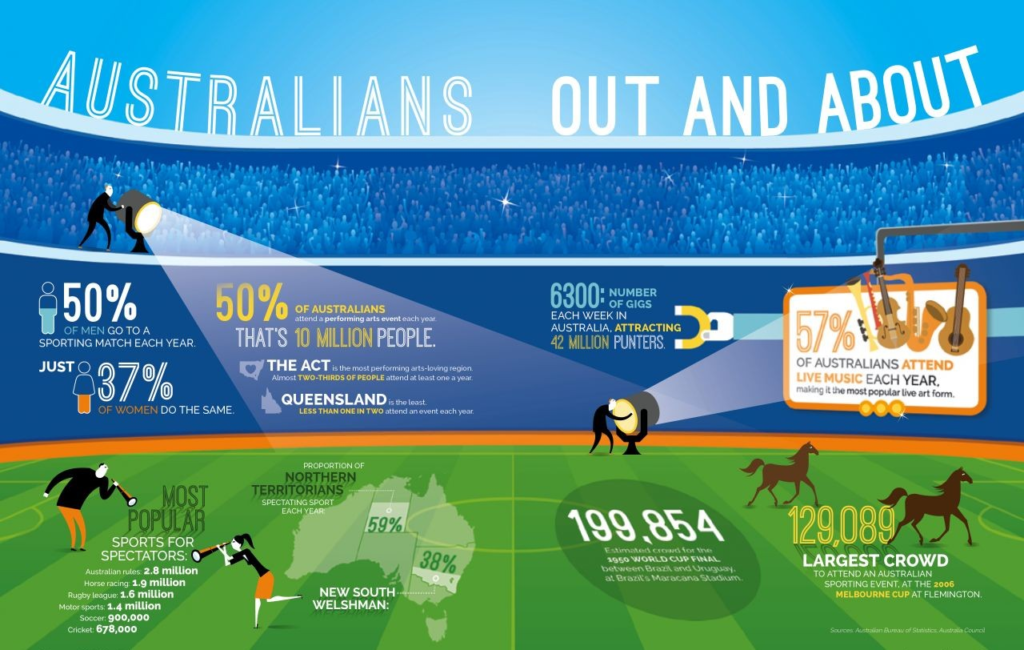

CLICK TO ENLARGE.

“It’s basically business interruption cover for events,” explains Damian Kerin, Head of Contingency at Beazley.

Events can include sporting fixtures, concerts, conferences, trade shows and speaking tours. Think the Cricket World Cup, a Jimmy Barnes concert, Sydney’s City2Surf, the stage production of Les Miserables – and even NIBA’s annual Convention. On a smaller scale, events can include medical conferences, the filming of commercials, or a health and fitness expo.

Event cancellation insurance has been available in Australia for over twenty years. But until relatively recently, QBE was the only local insurer writing this business, with most cancellation and abandonment policies written out of London until 2010.

Today, the major players in the Australian market are Beazley, Chubb and QBE, together with numerous Lloyd’s coverholders.

The entry of additional players into the Australian market has pushed rates down; Ian Stack, Associate Director of Action Entertainment Insurance, estimates that premiums are around 20% lower than they were three years ago.

Worldwide, event cancellation insurance is worth around $500-$600 million in premium. But the local market for this product is only a small proportion of the global pool, with experts valuing the Australian and New Zealand share at between $40-$50 million in premium. But Stack says there is untapped potential in the local market. In Stack’s view, event cancellation insurance “has been undersold until now”.

LOCAL ATTITUDES

Beazley’s Damian Kerin says the uptake of event cancellation policies is lower in Australia than in other parts of the world. “In the United States and Europe,” Kerin says, “cancellation insurance is mostly an automatic buy for sporting events.” Not so Down Under, although this is slowly changing.

Kerin attributes the difference – at least in part – to our laid-back, “she’ll be right, mate” attitude. The key to shifting this approach, says Kerin, is education: brokers need to make event organisers appreciate how easily things can go awry.

Robert Low, Manager for the Commercial, Event and Entertainment Division at Marsh Adelaide, agrees. “Many event organisers don’t have any idea of what can go wrong,” he says. Low explains that Marsh have a library of potential scenarios to share with clients to help them understand the many possible risks which can impact an event.

LEFT IN THE LURCH

Event organisers can be placed in difficult positions when presenters unexpectedly renege on commitments.

Action Entertainment’s Ian Stack says the relatively small size of the market means there are only a few brokers currently specialising in event cancellation insurance but there is much potential.

Step one, he says, is improved products. “The underwriting intention of the London-based policies is often unclear,” he says, “and the policies need to be better structured and written in plain English.”

Although Beazley’s base wording has recently been simplified to make it easier to follow, Damian Kerin admits that “there’s still a long way for insurers to go to educate brokers about this product.”

COMING ATTRACTIONS

Beazley is seeing a greater uptake of event cancellation policies as insurers better understand their client’s needs, and respond by becoming more flexible in order to individualise cover. For example, clients can choose to insure only costs and expenses, or to insure on a gross revenue basis so that their profit is covered. “Cover is so adaptable,” Kerin says, “that it’s truly a bespoke process.”

So how can brokers help event organisers, sponsors and promoters to minimise their exposure to risk?

Robert Low of Marsh is unequivocal: it’s the broker’s role to extract information from the client. He recommends that brokers specifically ask insureds the following question during reviews: “Are you organising or sponsoring any functions or activities which have the possibility of being disrupted or cancelled?”

RUINED HARVEST

Bad weather is often one of the biggest risks of insuring outdoor events. Over the last few years, QBE has had a number of claims resulting from poor weather – both leading up to and during events.

Clearly, there’s untapped potential for event cancellation insurance in the local market. As last year’s devastating siege at Sydney’s Lindt Cafe siege showed, Australia is not immune to random acts of terror. Even the possibility of a suspicious incident – like the unattended package found on a Sydney ferry earlier this year – could lead to a lockdown of a geographic area, with a potential flow-on effect for event organisers and their meticulously planned events.

It’s also important to understand that event cancellation policies can cover local insureds while they are overseas, so clients – and their brokers – need to be aware of global and not just Australian risks to events.

It may still be some time before Australian event organisers consider event cancellation insurance to be an ‘automatic buy’. In the meantime, there’s a need for insurers and brokers with the relevant expertise to collaborate and exchange knowledge. Because event cancellation insurance is all about understanding a client’s attitude to particular risks and tailoring the product accordingly.

As Damian Kerin explains: “you might have a client who isn’t bothered by the weather and is prepared to hold an event rain, hail or shine, but is concerned about the threat of terrorism.”

“The trick,” he says, “is working out what pushes people’s buttons.”